Mastering Manufacturing in Business Central: How Standard and FIFO Costing Work in Practice

In our last blog, we explored the theory behind different costing methods in Business Central—especially Standard Costing and FIFO (Actual Costing). But what does this look like when you put it into practice?

In this post, we'll summarize key takeaways from our live demo in Part VII of the Business Central Manufacturing Series. The demo compares how these two costing methods behave in a real manufacturing scenario within Business Central—from purchase to production to general ledger entries.

Understanding the Practical Impact of Costing Methods

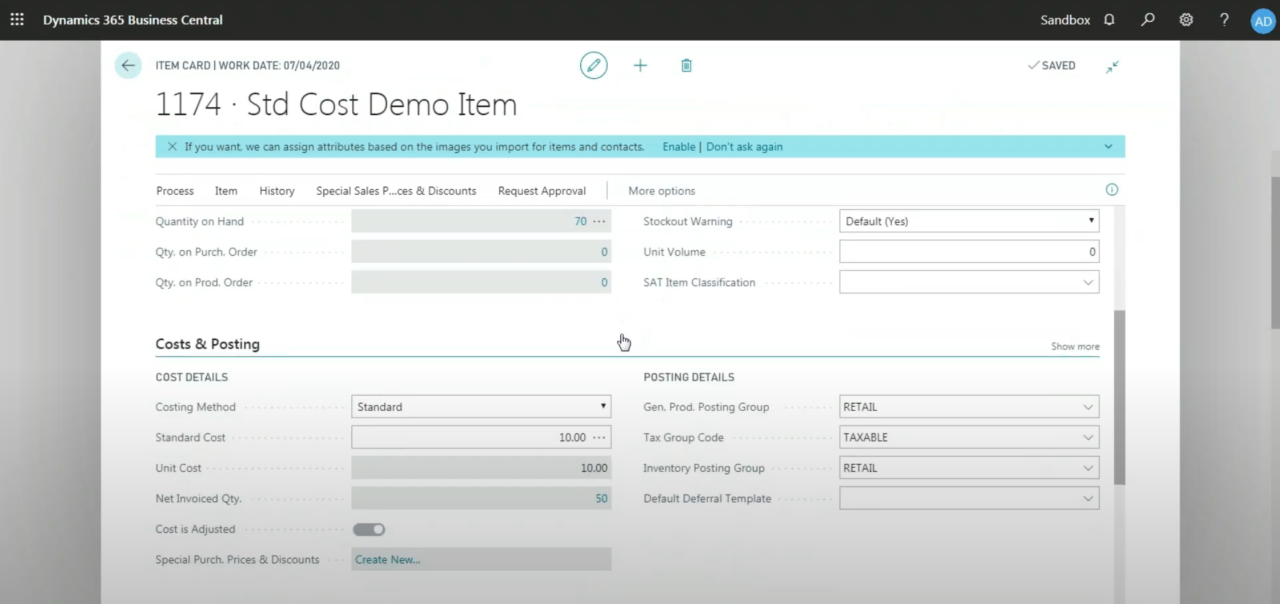

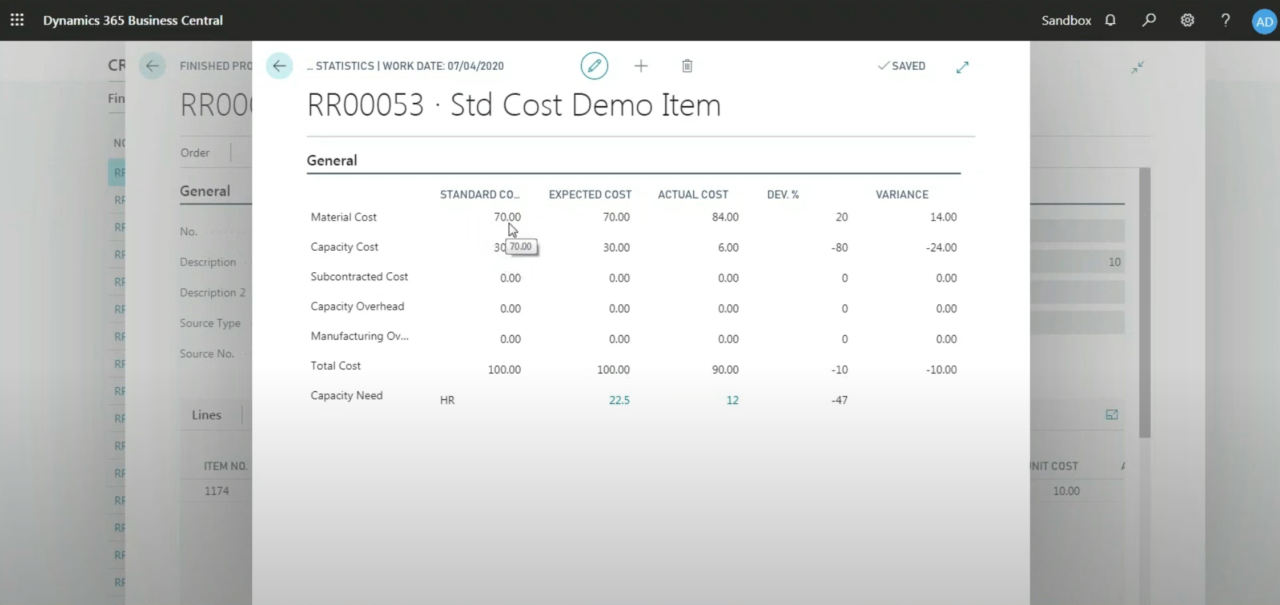

In the demo, we examine what happens when a production run doesn't go exactly as planned—think consuming more components than expected or spending less time on labour than estimated. While the setup involves a simple routing and BOM structure to keep the math clear, the purpose is to show how each costing method responds to changes in real-world execution.

How Business Central Treats Cost Differences

The main difference between FIFO and Standard Costing comes down to how Business Central handles variances.

With Standard Costing, the system always values inventory at the standard rate—even when actual costs differ. Those differences are recorded in dedicated variance accounts, giving manufacturers immediate visibility into cost overruns or savings. Whether it's extra materials used or labour that was faster than expected, Business Central calls it out clearly in the general ledger.

With FIFO, on the other hand, Business Central simply books the actual cost of what was consumed—no questions asked, no variances posted. It's clean and simple, but less informative if you're trying to identify process inefficiencies or cost discrepancies.

Why This Matters

Costing isn't just about accounting—it's about control and insight. If your business needs to track where costs are going off-plan, Standard Costing can help you identify those gaps and take corrective action. If your priority is reflecting actual costs with minimal complexity, FIFO may be the better fit.

The demo illustrates these differences clearly, showing how the same production run results in very different ledger entries, depending on the costing method used.

Want to better understand which costing method is right for your operations? Get in touch with WebSan Solutions to speak with a manufacturing expert.