T4A Generator

Automatically audit and generate your T4A submission

Supported Countries

Canada

Last Updated

January 28, 2026

Implementation Cost

$0

T4A Generator

Tax Filing Nightmares?

Don't fret! Over 80% of businesses struggle with complex tax forms like the T4A. Our T4A Generator App simplifies the process, eliminating the fear of costly mistakes.

Craving Accuracy?

Achieve 99.9% accuracy in your T4A forms, ensuring peace of mind and preventing costly penalties. Trust in a solution that delivers reliable results.

Unlock the potential of our T4A Generator App today!

Join the businesses that have already simplified their tax filing processes, saving both time and money. Say goodbye to tax worries and hello to efficiency and accuracy.

Features

Preparing T4A documents for the CRA (Canada Revenue Agency) can be a very tedious and daunting task when filing taxes, and if not done right, it can lead to a lot of headaches down the road. So instead of having to manually organize T4A amounts, why not have an application within Microsoft Dynamics 365 Business Central to manage it for you?

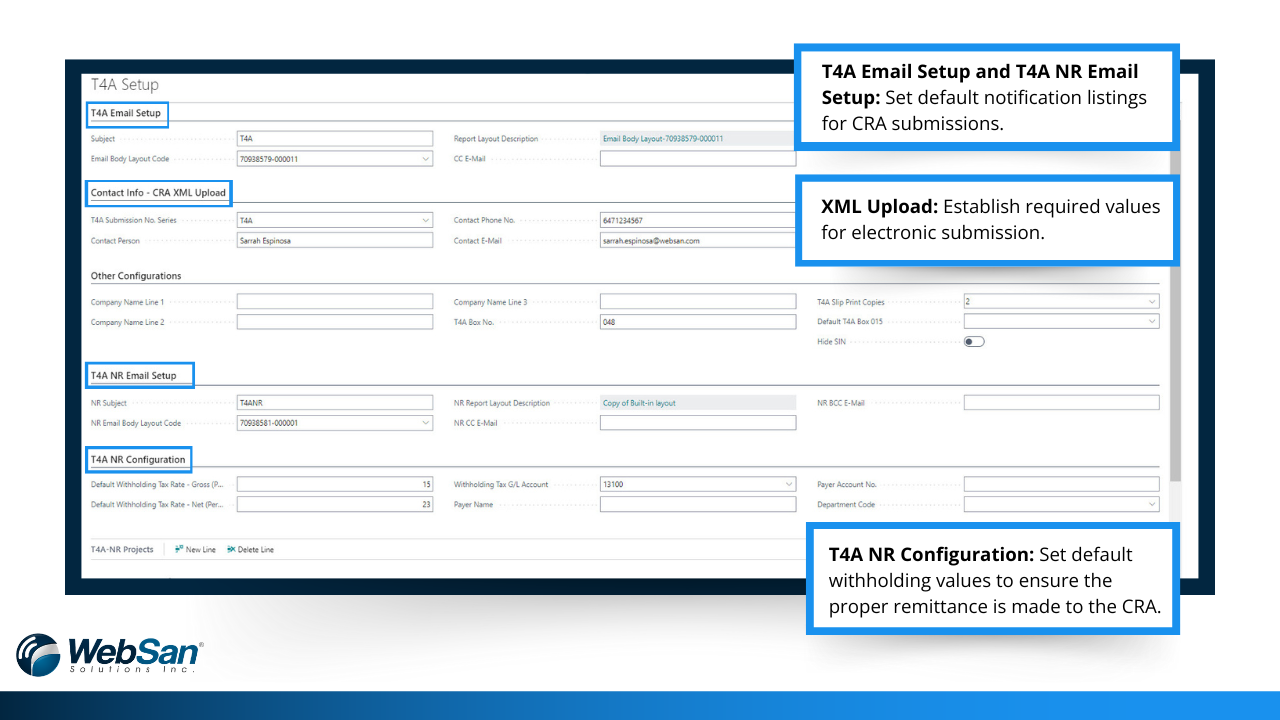

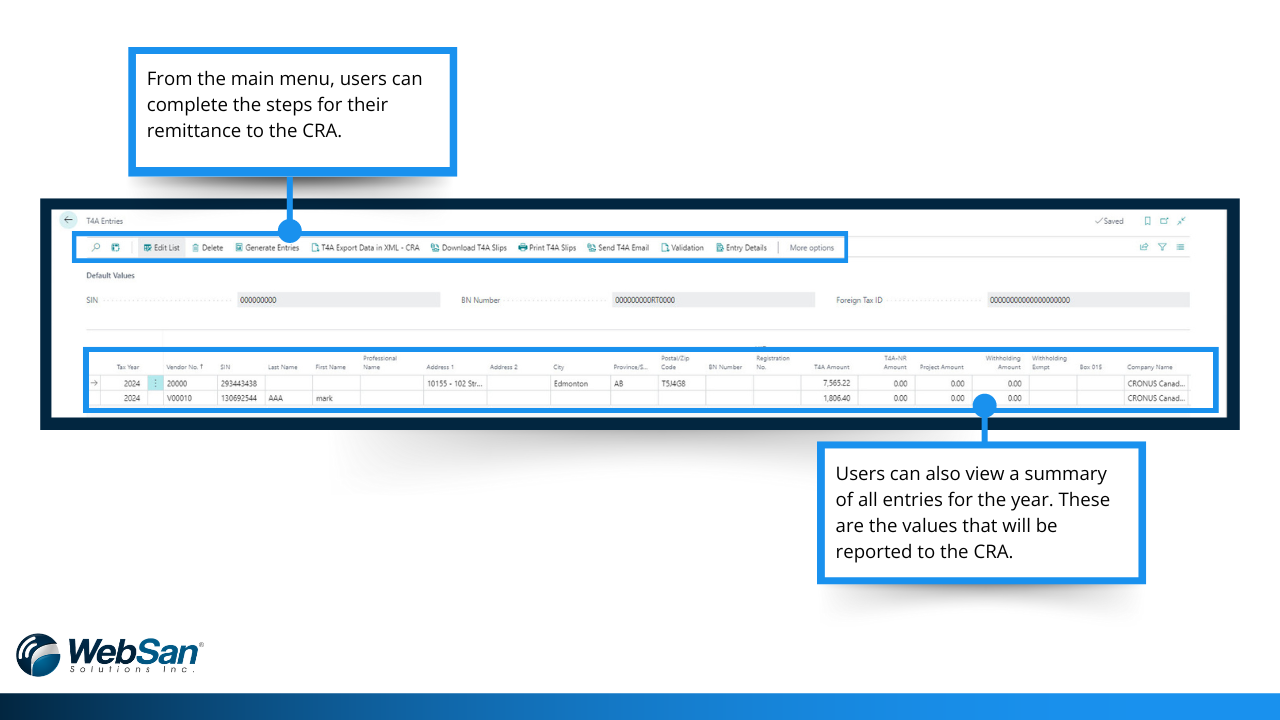

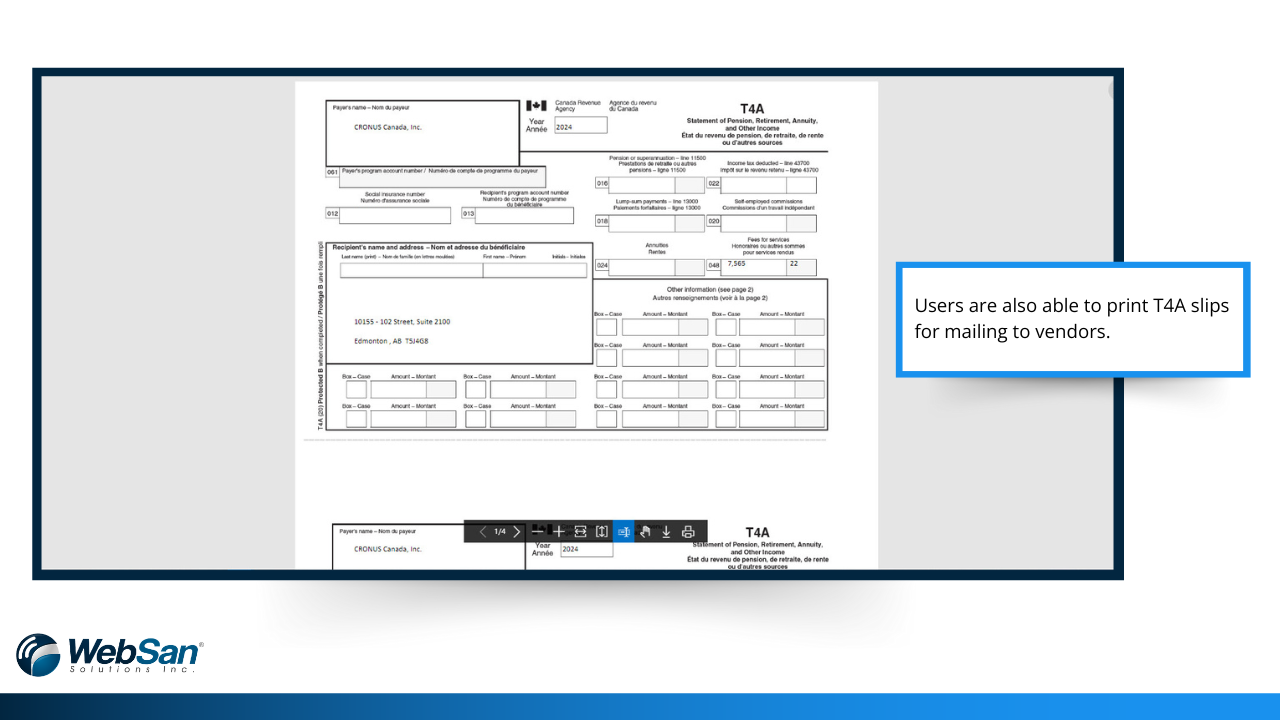

The T4A Generator application is a tool that can audit and generate T4A slips for your payees, email the slips to them, and generate T4A summary documents that can be submitted directly to the CRA.

The benefits of using our T4A Generator:

- Automatically audit and generate your T4A submission: Immediately capture and correctly file your payments which you can then generate the files acceptable by the CRA.

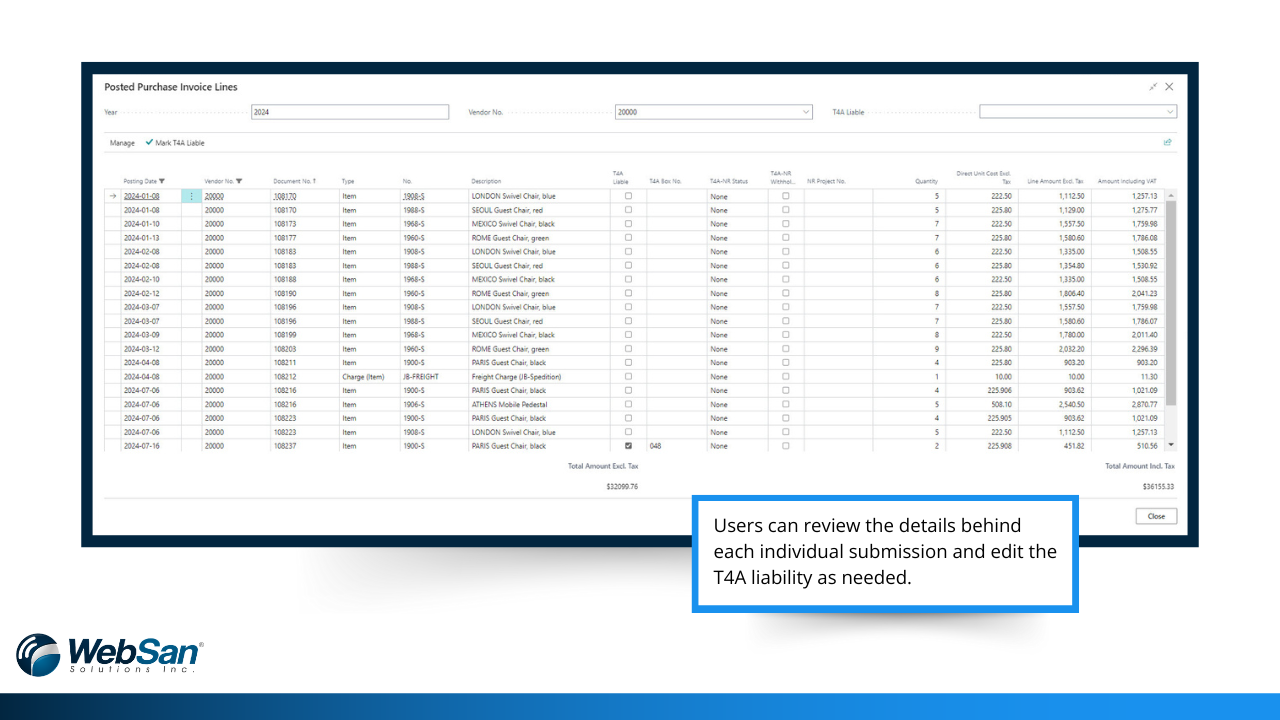

- Segregate tax-liable payments from non-tax liable: Through this tool’s intuitive setup, you will be able to assign specific payees as tax liable as well as identify specific payments as tax liable

- Reduce errors: No human interaction is involved with your audits, so there are minimal chances of error or delay.

- Faster processing: Generate T4A documents instantly with just a click of a button.

- Customizable filters and restrictions: When generating your T4A amounts, you can filter by date, payee, amounts, and so much more so that you only get the data you want to pull.

Start your free trial today!

Confidentiality: The application does not maintain employee payroll data outside of Business Central.

App Interactions

Supported Languages

English & French

Whitepaper

Boost Accuracy & Compliance with the Effortless T4A Generator App for Dynamics 365

Simplify your tax and payroll processes with the T4A Generator App by WebSan Solutions. This whitepaper provides an in-depth look at how the app streamlines the creation and management of T4A slips, helping businesses stay compliant while saving time. Learn about its key functionalities, benefits, and the significant impact it has on making tax and payroll processes more efficient for managing contractor payments. Download now to discover how the T4A Generator App can optimize your tax workflows and ensure hassle-free compliance!

Release Notes:

25.12.90.0 - October 16, 2025

- Updated the functionality and user interface.

- Updated the XML File for the CRA standard format

25.19.116.0 - November 21, 2025

- An Action button for Audit Posted Invoice Lines has been added to the T4ANR section

25.21.120.0 - December 5, 2025

- Implemented minor corrections in CRA file generation and withholding tax application within purchase orders

25.22.124.0 - January 8, 2026

- Updated XML Schema for 2026 Requirement

- Updated calculations for T4A/T4ANR Entries

- Implemented validations for the Company Name length exceeding the required limit

25.23.126.0 - January 13, 2026

- Minor fixes to the Box No. assignments

25.25.130.0 - January 15, 2026

- Minor correction in T4A Boxes assignment

25.26.132.0 - January 15, 2026

- Implemented minor fixes to improve payment partition handling for invoices with different T4A box configurations

25.27.134.0 - January 28, 2026

- Minor edit to tax calculation